salary to afford 700k house canada

200000 This example assumes you have no other debts or monthly obligations beyond your new housing costs a 20 down payment and a good credit score. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

If I Bought A Home For 600k And Sell It For 800k How Much Will I Make Quora

Property tax 255month 500000 x 00061101 12 Heating 60month.

. Annual Household Income of 180000. With that down payment your 200000 mortgage would buy you a home worth 250000. Thats the minimum youll need in order to qualify for a large enough mortgage.

The minimum down-payment for a home in Canada must be at least 5 of the homes value but this isnt always true. To buy a million-dollar home in Canada youll need a yearly income of at least 175230 as well as a cash down payment of at least 200000. For houses less than 500000 in price you need a down-payment of only 5.

So 2700 per month or about 32500 annually. That means you should be making something like 120000 per year to afford a. Housing prices being so crazy right now and any decent house sells for at least 750k.

The annual increase in value on a detached house will easily surpass both your before and after tax income for. Im guessing with insurance and property taxes but lets say another 7500 per year for a total basic home cost outlay of 40000 annually. Me and my wife earn a combined 180K before taxes and bonus.

Compare Quotes See What You Could Save. We want to identify remove and prevent barriers to accessibility at CMHC. Total of 300 Mortgage Payments.

There is nothing that is more valuable than a detached house in GTA. You should aim to buy a detached house with at least 1M even a small 25105 lot will do in a good area. How much do you have to make a year to afford a 200000 house.

This calculator steps you through the process of finding out how much you can borrow. If your down payment is 25000 or less you can find your maximum purchase price using this formula. The first steps in buying a house are ensuring you can afford to pay at least 5 of the purchase price of the home as a.

Someone who earns 70000 a year will make about 5800 a month before taxes. A house that is 700k in GTA core area is absolutely nothing. Can we afford a house a 700K Mortgage.

Down Payment Amount - 25000 10. I live and work in Toronto and me and my wife are planning to buy a house around the GTA area. Half condo fees 200month.

Ad Knowing How Much You Can Afford Is The First Step Towards. With your monthly household expenses amounting to 3442 this means the required minimum income for a 500K mortgage under the Stress Test is 130000 per year. Heres the short answer.

Created with Highcharts 307. Interest rates shown are for sample purposes only. Salary to afford 700k house canada.

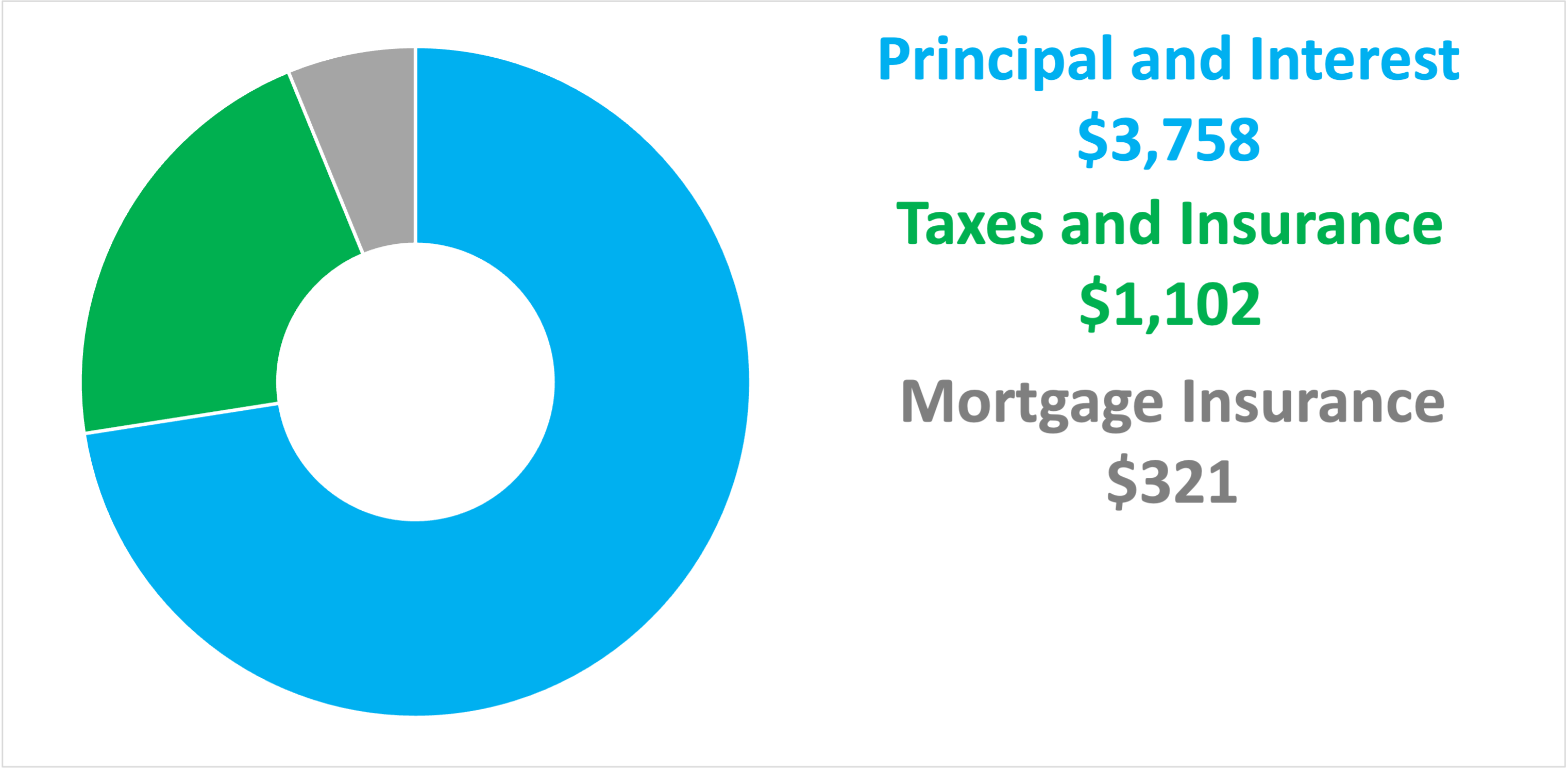

81 4 11 4 Mortgage Payment Property Taxes Other Cost Home Insurance. For houses that cost more than 500000 you have to put 5 down on the first 500000 plus 10 of any amount above 500000. To afford a house that costs 600000 with a down payment of 120000 youd need to earn 89528 per year before tax.

Can we afford a house a 700K Mortgage. 51 rows To afford a house that costs 700000 with a down payment of 140000 youd need. Property tax 255month 500000 x 00061101 12 Heating 60month.

Well that or youll need 1 million in cash in order to avoid taking out a mortgage. What Is The Income. Salary to afford 700k house canada.

Personal finance experts recommend spending between 25 and 33 of your gross monthly income on housing. If your down payment is 25001 or more you can find your maximum purchase price using this formula. With a 45 percent interest rate and a 30-year term your monthly payment would be 2533 and youd pay 912034.

Find Mortgage Lenders Suitable for Your Budget. CMHC is not be liable for loss or damage of any kind arising from the use of this tool. Fill in the entry fields and click on the payment schedule button to see a complete amortization.

What Is The Income Needed For 500k Mortgage In Canada FHA loans typically allow for a lower down payment and credit score if certain requirements are met. Salary to afford 700k house canada. Half condo fees 200month.

The first steps in buying a house are ensuring you can afford to pay at least 5 of the purchase price of the home as a down payment and determining your budget. 465 60 votes A mortgage on 200k salary using the 25 rule means you could afford 500000 20000 x 25. Interesting number because that is what the median house price is in Seattle Washington these days.

The salary you or your household need to make in order to purchase a home in Toronto and the GTA based on average prices in 2021. While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator. Compare Quotes Now from Top Lenders.

Ad Get Your Best Interest Rate for Your Mortgage Loan.

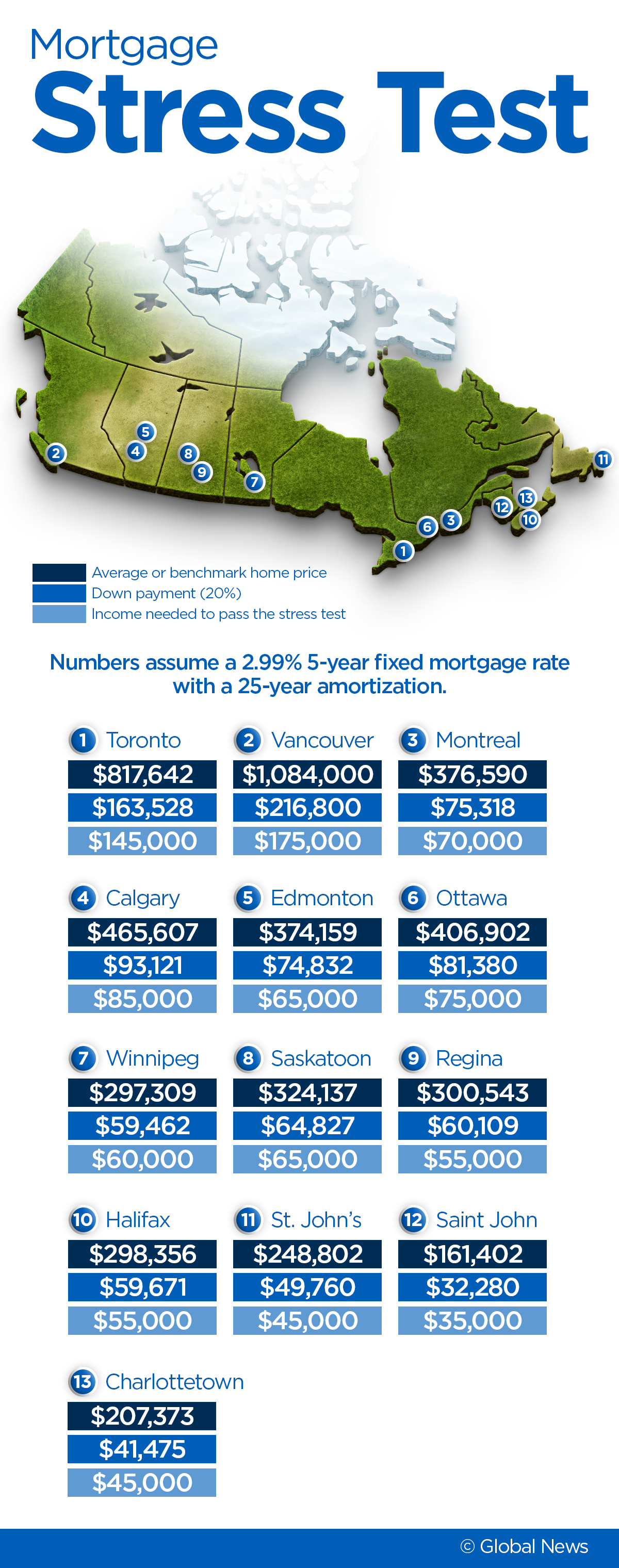

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Amy Stuart On Twitter Average Family Income Canada 1975 50k 2015 70k Average House Price Toronto 1975 60k 2015 700k Average Tuition Costs Canada 1975 550 2015 6200 Remember These Numbers Next

What Is The Income Needed For 500k Mortgage In Canada

What Income Do You Need To Afford A 1 Million House In Toronto Lowestrates Ca

How Much Should My Salary Be To Buy A 3 Million Usd House Quora

What You Need To Earn To Buy A House In Every Major Canadian City Workopolis Blog

Household Income Of 140k Is It Too Risky To Buy House For 700k R Personalfinancecanada

How Do People Rationalize Paying 1 1 Million Dollars For This Because Some Realtor Staged It Nicely R Canadahousing

La Canada Ca Real Estate La Canada Homes For Sale Realtor Com

/story/featureImage/d38fbad6d0c7a19ea31cc9c4de4e70f29632.jpg)

Can I Afford A 780k House On A 125k Salary

How Much Annual Income Do You Need To Be Able To Afford A 750k Home In Canada Quora

What 700 000 Buys You In California The New York Times

700k Mortgage Mortgage On 700k Bundle

What 700 000 Buys You In Texas Oregon And North Carolina The New York Times

Why Buying A Home Is Rarely A Smart Investment Seeking Alpha

How Do People Afford 700000 Dollar Homes Clearance 60 Off Www Simbolics Cat

How Much You Need To Make Annually To Afford A 700k House

If You Re Thinking Of Selling Now Is The Time As Economists Warn Canadian Housing Market Crash Is Imminent R Londonontario

How Do People Afford 700000 Dollar Homes Clearance 60 Off Www Simbolics Cat